Master Your Taxes with Confidence

Exclusive Services

This service covers individuals with W-2 income, who are not self-employed and do not itemize deductions. Ideal for those filing as Single or Head of Household with or without dependents. We'll ensure you claim all eligible credits and file accurately and on time.

Federal and State

Form 1040 and Schedule C (common deductions like home office, mileage, equipment, depreciation)

For freelancers, gig workers, contractors, and small business owners. This service includes Schedule C filing, calculation of self-employment tax, and maximizing eligible business deductions. We'll help you stay compliant while keeping more of what you earned.

For registered businesses such as LLCs, S Corps, C Corps, and Partnerships. This service includes full preparation of your federal and state returns, owner/shareholder K-1s, and expense tracking to ensure compliance and maximize deductions.

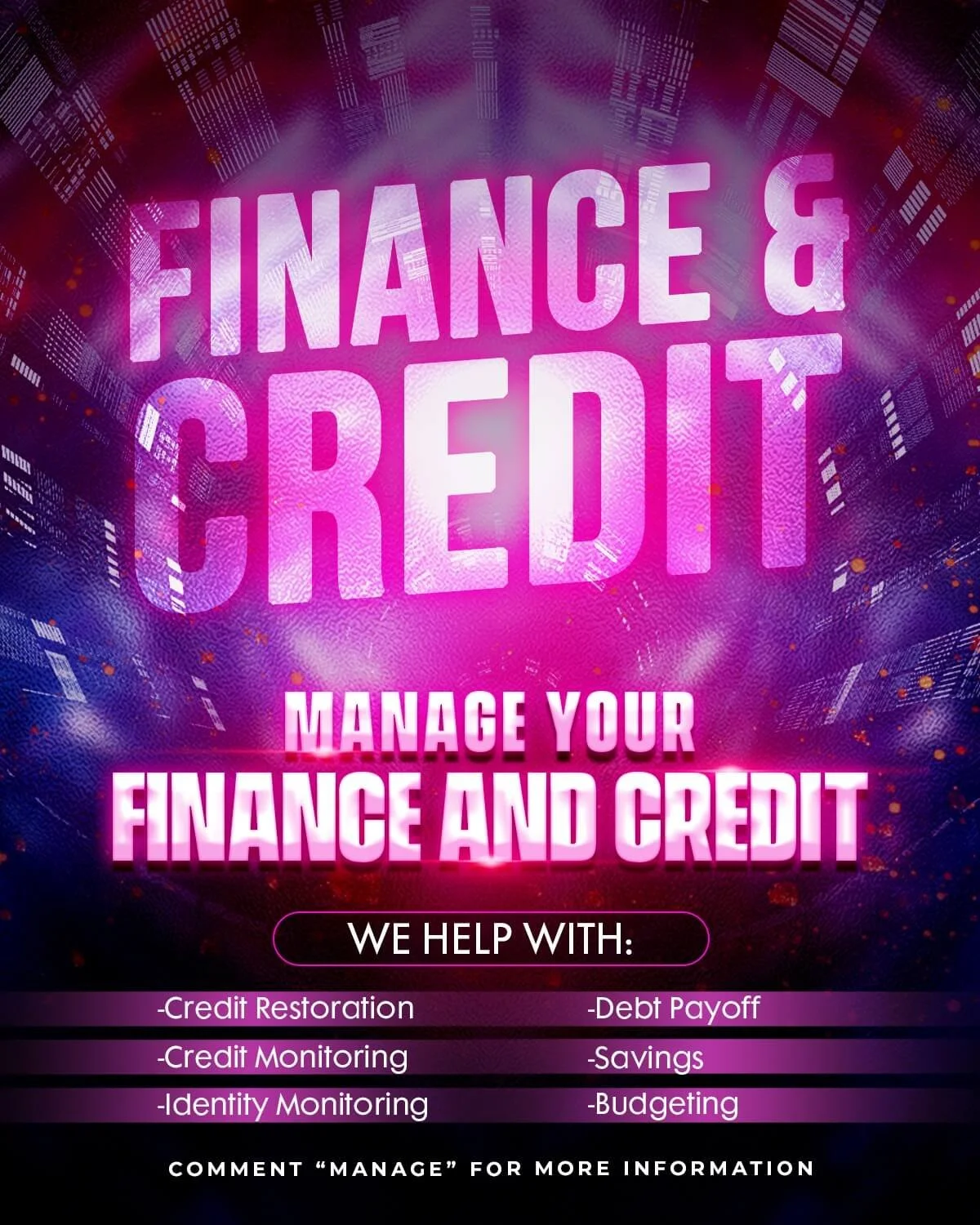

Is your credit below 670? Let’s talk!

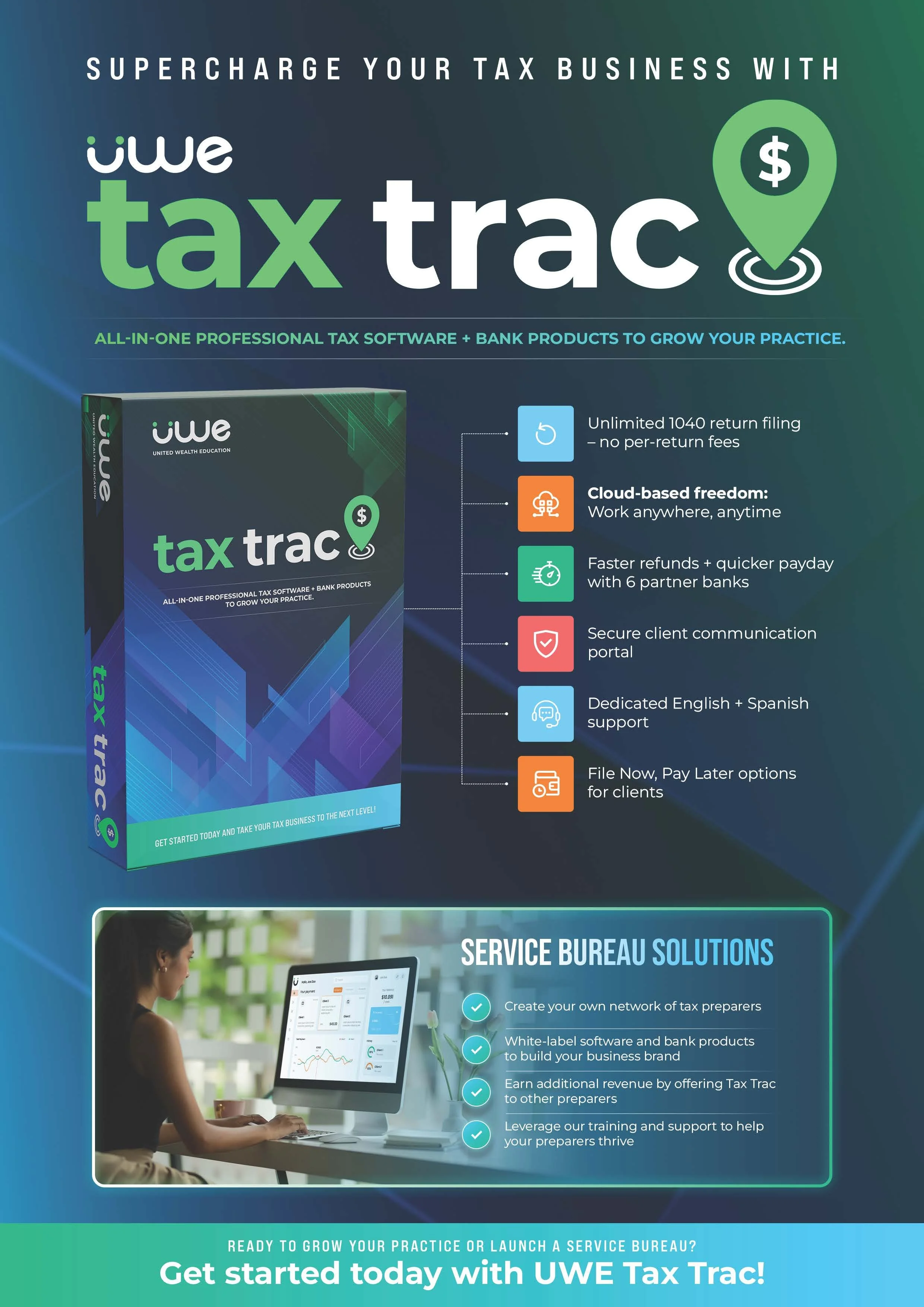

Ready to move forward? Register here: www.ucespp.net/ERod

We help with Petition of Relatives, ITIN Applications, and Naturalizations.

Average price per form $150